Present value of deferred annuity calculator

Because annuities offer many benefits lottery winners retirees and structured settlement recipients use them to create predictable cash flow for the present future and even after their death. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for.

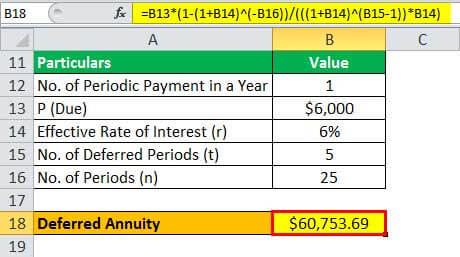

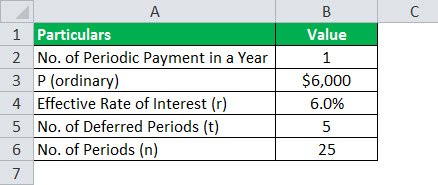

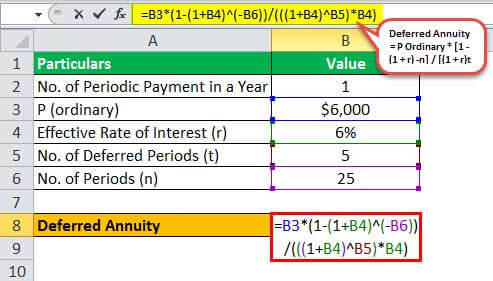

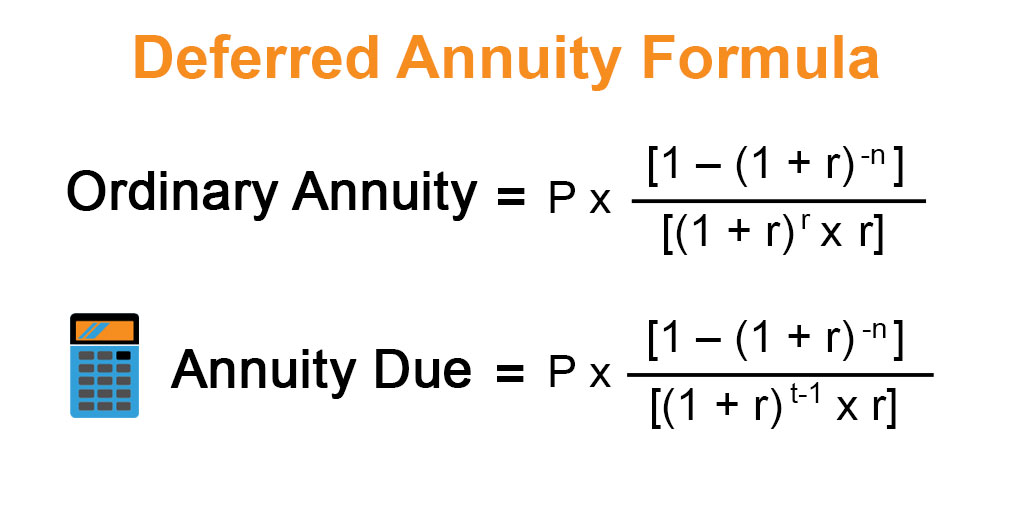

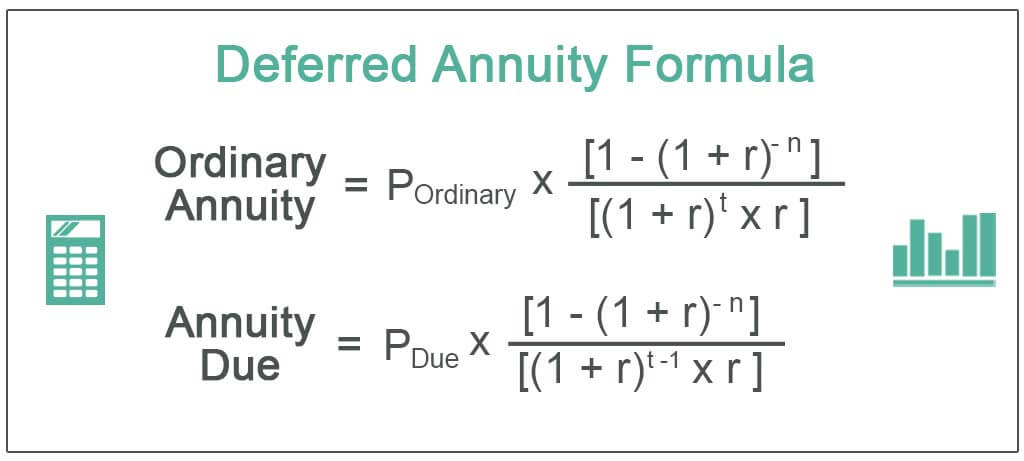

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

As present value of Rs.

. For example if you invest 1000 at an interest rate of 5 for ten years the future value of your investment would be. Annuity calculator for terms of 1 to 10 years. Stands for the number of periods in which payments are made The above formula pertains to the formula for ordinary annuity where the payments are due and made at the end of each month or at the end of each period.

The interval can be monthly quarterly semi-annually or. FV Pmt x 1 i n - 1 i. There is also a 100 core contract fee included with this annuity.

5000 it is better for Company Z to take Rs. Read more of Present Value of an Annuity. Several formulas are also used such as the standard renewal formula.

The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date. This is meant to protect Jackson from the many risks that annuitants those who receive an annuity present a company while the latter is more clerical. Once the annuitization or distribution phase begins again based on the terms of your.

P Present value of investment. Immediate Life Annuity- Rs87 527 Immediate life annuity with return of purchase price- Rs206155 Deferred life annuity with return of purchase price-Rs108303 Max-no limit Disclaimer. Future value FV is a measure of how much a series of regular payments will be worth at some point in the future given a specified interest.

Tax-Deferred Annuity Tax-Deferred Annuity A tax-deferred annuity is an employee retirement benefit plan where both an employer and its employee. Fixed interest deferred annutities. I Interest rate expressed as a decimal n Number of years the investment will be held.

Rate Per Period As with any financial formula that involves a rate it is important to make sure that the rate is consistent with the other variables in the formula. Present value is linear in the amount of payments therefore the. The future cash flows of.

Human life value Calculator - HLV calculator helps you calculate the life insurance needs and term life cover amount. F Future value of investment. A regular-pay deferred annuity plan that helps you gradually build the retirement savings and provide guaranteed income for life.

Explanation of PV Factor Formula. Present Value Of An Annuity. F 10001 00510.

In essence when you buy a deferred annuity you pay a premium to the insurance company. An annuity is a financial instrument that accrues interest on a tax-deferred basis and protects against market risk and longevity risk. Calculating the Future Value of an Ordinary Annuity.

1 1 r-nr PV. The following are additional tools to help with your annuity research. The future value of an annuity formula is.

Stands for Present Value of Annuity PMT. Stands for the Interest Rate n. Where is the number of terms and is the per period interest rate.

Using the deferred annuity calculator the f future value of annuity formula of the usual rental a series at the end of each month is calculated. But you will need this present value calculator to plan your childs education or any other major expenses or purchases. Deferred payments are by far the most popular type in the United States and they are the best choice for an investor who doesnt need instant income from an annuity.

However if you can manage to have an account or withdrawal value of at least 50000 you can waive this annual charge. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. Reports investment value interest rate year end values and yield to term for each year of the annuity.

The present value is given in actuarial notation by. Present Value of an AnnuityC11ini where C is the cash flow per period i is the interest rate and n is the frequency of payments. A deferred annuity is an annuity that begins at some point in the future.

The ordinary annuity formula is used to determine the ordinary annuity calculator present value. PaymentWithdrawal Frequency The paymentdeposit frequency you want the present value annuity calculator to use for the present value calculations. Figure Out the Net Present Value of an Annuity.

Number Of Years To Calculate Present Value This is the number of years over which the annuity is expected to be paid or received. Present value means todays value of the cash flow to be received at a future point of time and present value factor formula is a toolformula to calculate a present value of future cash flow. Human Life Value HLV or Ideal Life Cover is a number that tells the present value of.

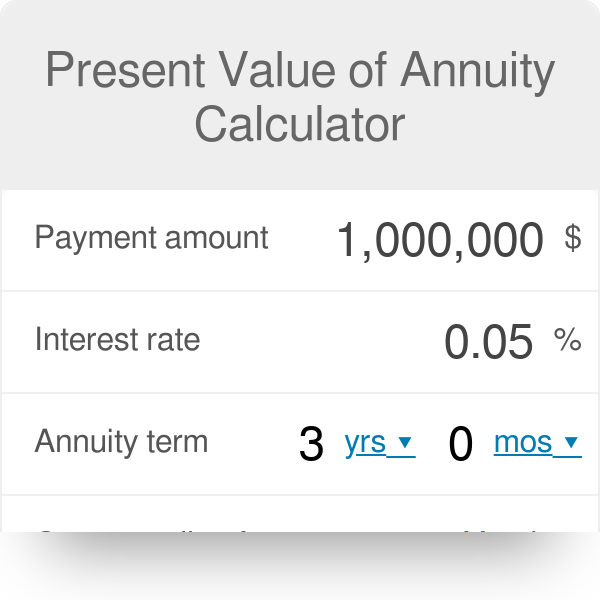

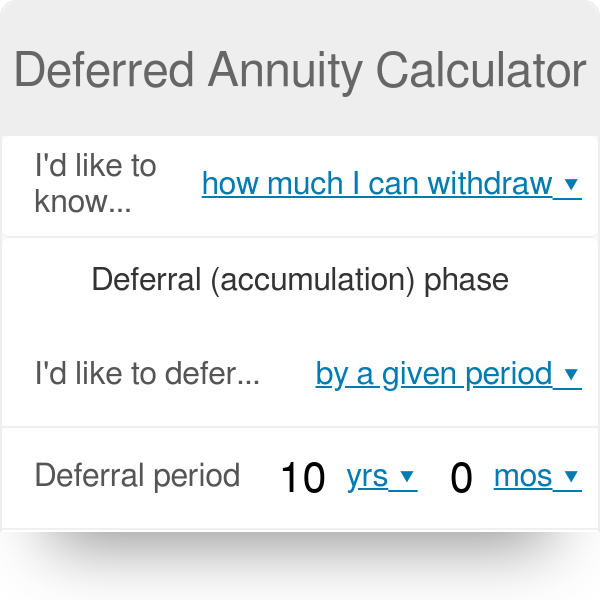

5500 after two years is lower than Rs. They provide the value at the end of period n of 1 received at the end of each period for n periods at a discount rate of i. This calculator can calculate the payment amount for a deferred annuity given the present value number of payments and interest rate.

That initial investment will grow tax-deferred throughout the accumulation phase typically anywhere from ten to 30 years based on the terms of your contract. Stands for the amount of each annuity payment r. Policybazaar does not rate endorse or recommend any specific insurance provider or insurance product offered by any insurer.

The purpose of the future value annuity tables is to make it possible to carry out annuity calculations without the use of a financial calculator. Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

Ordinary And Discounted Annuity Annuity Due Deferred Annuity Lessons Blendspace

Present Value Of Annuity Calculator

Chapter 5 Time Value Of Money Ppt Video Online Download

Present Value Of Annuity Calculator

Present Value Of A Growing Annuity Formula With Calculator

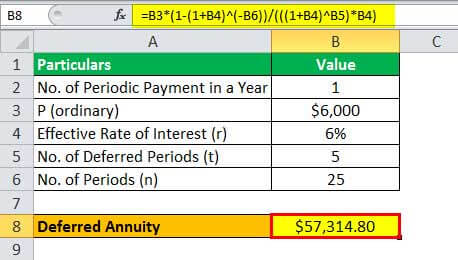

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Chapter 06 Time Value Of Money Ppt Download

Future Value Of An Ordinary Annuity Calculator Shop 50 Off Www Ingeniovirtual Com

Deferred Annuity Calculator

Annuity Payment Pv Formula With Calculator

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Present Value Of An Annuity How To Calculate Examples

Ordinary And Discounted Annuity Annuity Due Deferred Annuity Lessons Blendspace

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Chapter 5 Time Value Of Money Ppt Video Online Download

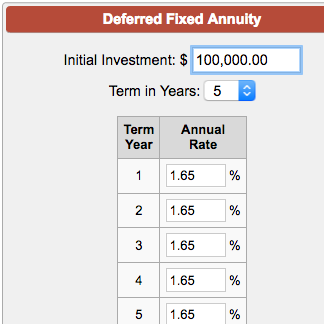

Deferred Fixed Annuity Calculator